Investing

| Favourite Sites |

Favourite Blogs |

Saturday, January 15, 2011

Eagle Rock (EROC), Kerrisdale and Investment Timelines

I sold out the last of my EROC position in the last few days. I first wrote about EROC in mid July 2009 - Eagle Rock Energy Partners (EROC). I first pegged the value between $7.66 and $8.90 when EROC was trading around $3. In late July 2010 I posted an updated Valuation of Eagle Rock Energy (EROC) post transactions. This pegged a reasonable valuation, based on a weighted average of managements estimates contained in SEC filings, at $9. As EROC is now at around $9.40 I’ve closed all my positions in the stock and warrants.

When EROC was trading at $3 there was a forced seller and a belief that they could violate bank covenants. The forced sellers had purchased EROC for yield and the distribution had been cut to 2.5c per quarter. In reality the bank covenants could not be violated as the company had control over their hedges which provided a backdoor mechanism to remain in compliance. EROC subsequently announced a series of transactions to affect a recapitalization. There was a lot of controversy over the transactions. Kerrisdale Capital launched a site fair-eroc.com to vote down the proposal. Kerrisdale do good work and I bet they have a terrific run rate. However, this time they got it at least partially wrong. Kerrisdale outline their concerns at fair-eroc.com;

“So what remains? In our view, NGP is essentially canceling (sic) its subordinated units in exchange for $29mm (plus associated rights/warrants if they receive the fee in shares). These subordinated units are not worth $29mm+. With $1.65+ of arrearages ahead of them, the subordinated units will be underwater for 5+ years. We at Kerrisdale believe they are worth very little.”

In fact they were worth around $40M. I contacted Kerrisdale about their methodology for calculating the value. They had not calculated a value for those units but held a belief that the value was so far in the future that the uncertainty would wipe out all the value (sounds like an option doesn't it!). I calculated an undiscounted cashflow of nearly 400M and a discounted value of $40m. EROC was paying $35.5M for them. Kerrisdale did manage to bring about some minor changes in the plan and I appreciate their efforts to put management on notice.

As a result of the initial offer I valued EROC at $8.58 which was then updated by a few percent after the revised transaction was announced.

In Kerrisdale’s 8/10/10 post on their activism efforts (login required) they note

“In the end, however, unitholders voted in favor of the plan. We’re not exactly sure why – the restructuring was clearly less than ideal, and we’re confident that NGP would have sweetened the offer if holders had rejected the initial proposal.”

The answer may lie in Behavioural finance. There is a famous experiment called the Ultimatum Game in which two volunteers participate. “The first player proposes how to divide the sum between the two players, and the second player can either accept or reject this proposal. If the second player rejects, neither player receives anything. If the second player accepts, the money is split according to the proposal. The game is played only once so that reciprocation is not an issue”. In many cultures a 50/50 split is offered and an offer below 20% is usually rejected. The most economically rational decision is to keep $19 and offer $1. The 2nd volunteer is still $1 better off but a 19/1 split is usually rejected. In this case NGP developed a proposal that offered value far from 50/50 but probably at around the 80/20 line (80 to NGP of course!). The reality was that EROC holders were offered incremental value, just substantially less than the value to NGP. Kerrisdale may well be right that NGP would have come back with a better offer but the offer on the table was accretive to shareholders.

At $9.39 there are a number of risks to EROC. Natural gas prices, interest rates, refinancing and capital investment risk. There are lots of ways EROC could be worth less than $9.40 and far fewer ways that it could be worth substantially more.

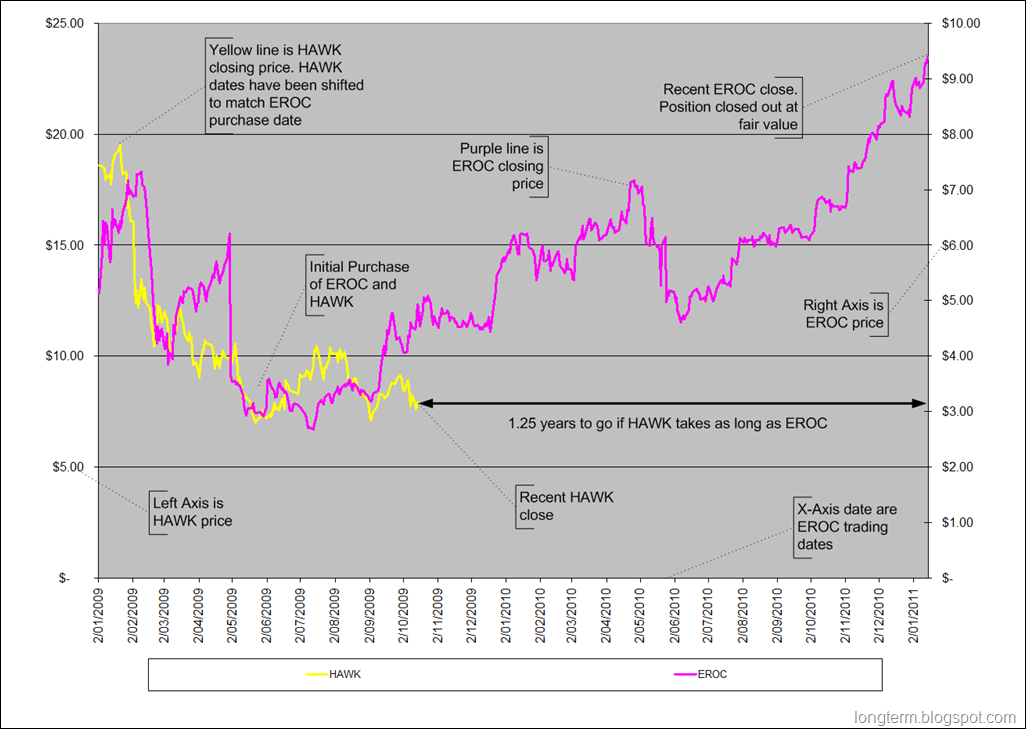

Finally, as this seems to have turned into the Seahawk (HAWK) blog it’s interesting to note the EROC timeline with a Seahawk overlay. The Seahawk closing prices are shifted to match my initial purchase of both HAWK and EROC.

If HAWK takes as long to play out as EROC then there are still 15 months to go. I have no particular insight that this is an appropriate timeline. However, if your timeline is substantially less than 1-3 years then you are unlikely to see this play out before you (have to) close your position.

The biggest risks I see are:

* the mexican issue but at these prices it still doesn't seem relevant.

* a chapter 7 announcement eventually which would probably give investors a chance to buy shares even cheaper with a catalyst to realize value

* Selling rigs for less than what we assume as scrap value but I just don't see that as a real possibility because they are rigs that are in service or have not been out of service for an incredibly long period of time (on average).

Just looking for you to throw some cold water on my face.

<< Home

Archives

April 2003

May 2003

June 2003

July 2003

August 2003

September 2003

November 2003

January 2004

February 2004

March 2004

April 2004

May 2004

June 2004

July 2004

September 2004

October 2004

February 2005

March 2005

April 2005

May 2005

June 2005

July 2005

August 2005

September 2005

December 2005

April 2006

May 2006

June 2006

January 2007

December 2007

February 2008

April 2008

May 2008

June 2008

July 2008

August 2008

September 2008

October 2008

November 2008

December 2008

January 2009

April 2009

May 2009

July 2009

August 2009

September 2009

October 2009

January 2010

February 2010

April 2010

July 2010

August 2010

October 2010

November 2010

January 2011

February 2011

April 2011

June 2011

Disclaimer and Disclosure

Analyses are prepared from sources and data believed to be reliable, but no representation is made as to their accuracy or completeness. I am not paid by covered companies. Strategies or ideas are presented for informational purposes and should not be used as a basis for any financial decisions.

To reduce Spam click here for my email address.