Investing

| Favourite Sites |

Favourite Blogs |

Tuesday, December 27, 2005

Thoughts for 2006

1. NASDAQ tanks - inverted yield curve, bull market long in the tooth, crazy valuations, presidential cycle, fed tightening all portend an economic slow down which will almost certainly drag the NASDAQ down

2. Silver rises - silver demand has not been met by mine supply for decades, there is less silver in the ground than any other metal, silver is consumed by industrial processes, inflation. These have been the case for some time so I expect this to continue crawling in my direction

3. Oil doesn't drop - No big oil discoveries in decades, reserves have not been replaced by majors for a decade, Saudi Arabia has no more light oil, Alternative sources will come online but only at high prices. Canadian Oil Sands (COS.un COSWF) reaches a yield of 10% on today's price.

4. Lead (the metal) doesn't drop more than 10% - China, India, Brazil continue to grow at very high rates and consume lead products (cars, batteries), lead in deficit, decline of the dollar. Ivernia (IVW) does well in this environment.

5. Uranium doesn't drop - High oil prices, increasing energy demands, Uranium is the cheapest source of energy, Uranium in deficit. STM doubles and is probably bought out (I'd rather it wasn't!)

6. Coal doesn't drop as much as the experts expect - Coal is the second cheapest source of energy, coal is required to produce steel, over production of steel requires more coal (steel can drop and coal increases), supply constraints due to infrastructure, Australia is closest to China and India, developing technologies like hydrogen and coal gasification support coal demand. Felix resources up.

7. The drop in the NASDAQ scares the market and everything drops for a while and then commodity stocks revive without a revival in the NASDAQ.

8. US Rates peak for this cycle and fall from that peak, USD falls against Canadian dollar, USD falls against AUD.

I'm sure I’m going to be right in these calls just not sure that it will happen over the next 12 months. The only time based position I have is in my QQQQ puts which expire in Jan 07, I'll probably buy more expiring in Jan 08. There is a chance that the drop in US markets will create a gun shy environment for stocks and even though commodities will outperform, commodity stocks will not. That is the second most likely scenario.

Worst case scenario, NASDAQ rises, commodities fall signficantly, USD rises against all currencies. Quite unlikely.

Tuesday, December 13, 2005

Felix Resources - The case for coal

I haven't written much about Felix resources which is a Queensland, Australia based coal company. Right now they are my favorite idea for 12-24 month upside. The company is expected to make between $60M and $70M AUD this financial year and is trading $375M AUD. That will lead to a PE of around 6. They have traded as high as 3.94 in the last 12 months and closed today at 1.91, less than 20c above their 12 month low of 1.75.

There are two factors that are driving down the price of Felix. One is common to all Australian coal stocks and the other specific to Felix. Most coal out of Australia is sold on 12 month contracts. It is coming up to the time of year when these contracts are renegotiated and all the media is talking about is how much lower this years rates are going to be. The chairman of Macarthur coal one of the few people to take the other side has come out and said that the coverage is far to negative and the results are likely to be better than many analysts estimates (the same analysts who were saying silver was a sell at $6.50 and oil was going back to $40). Of course it is the long term price of coal that drives the value of Felix and even the pessimistic brokers estimates are around $2.40 fair value. The long term price of coal will be driven by the growth of China and India. Coal is a very cheap source of energy and can even be converted into gasoline or hydrogen fuel.

The next incident that has driven the price down the final 15% is an announcement that one of their buyers have not been ready to accept PCI coal (which is a replacement for coke in industrial processes) and Felix had to sell the coal instead as thermal coal at a much lower margin. This will scrape $6M off this years estimates (my values above of 60-70M earnings already had the $6M discount applied).

Canadian oil sands trust (COSWF / COS_t.un) went through a similar set of circumstances last year when they announced cost overruns on their stage 3 project. COS dropped around 20% in the short term only to be up hundreds of percent 18 months later.

The way Felix announced their profit downgrade concerns me. They announced to the market that their sales volumes would remain the same but there would be a profit impact. They didn't specify the size and the exchange halted trading and asked Felix for more information. Furthermore the Financial Review is reporting that the Managing Director went on holiday as the announcement was made and is not available for comment. My trading rules say this has to be a pretty compelling opportunity if management is poor. Well at this point I'm not convinced one way or the other on management though this is definitely a strike in the wrong direction; however, the discount to intrinsic value is compelling.

While I haven't updated my valuation for Felix, it had a good chance of being a double from here and isn't likely to trade at a 5 PE for long. Strathmore remains my favorite idea of all and is showing some strength lately, however it is likely to take longer to play out that Felix. The information below was put together before the white mining acquisition and is somewhat old. However the case for coal is identical and Felix is only more valuable after the acquisition.

*****

Felix resources (formerly Auiron energy), based in Queensland, Australia is significantly undervalued based on the current price of coal. There are many reasons outlined here to believe that coal has significant upside and relatively low risk to the downside, even at the average coal price (adjusted for inflation) over 1981-1998 Felix has a fair value over $10 AUD. It is currently trading at $2.68 AUD on Feb 25th, 2005.

Felix operates one mine called Yarabee and from 2005 onwards plans to produce 1,700,000 tonnes at this mine. In addition itÃ??s Minerva mine is expected to produce 2,500,000 tonnes from 2006 through around 2015. Finally they have just purchased (subject to shareholder approval) White Mining which is expect to double their annual production. None of these estimates include any consideration of the White Mining purchase as the details have not yet been released.

Felix produces two main types of coal, a coking coal and thermal coal. Coking coal is used in the production of steel where thermal coal is used in power stations. Japanese steel mills are the major consumer of coking coal from Australia and itÃ??s usually sold under long term contracts.

If we look at an indicative year of production it can help provide some idea of the valuation. Production of 4.2M tonnes, with $11.8M AUD in fixed costs and 198M AUD in variable costs, with thermal coal receiving $53.76AUD a tonne (the 2004 average and below the current spot price) and coking coal at a $10 USD premium the company is fairly valued at $2.78 AUD with income at around $254M AUD (profit of 43.8M AUD).

If you increase the coal price assumptions to todayÃ??s spot prices as reported by ANZ bank $49USD tonne, and coking coal at $90 USD (the price that Felix just entered a 1 year contract with Japanese steel mills) then the fair value is $9.25 AUD. Furthermore if you take the coking coal at a $20 USD premium to spot thermal coal (coke = $69USD a tonne), fair value is $6.27 AUD still leaving a 130% upside.

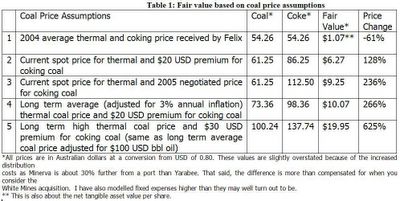

Table 1 shows the fair value and upside potential based on various assumptions. I think assumption 4 is the most reasonable with a fair value of $10 AUD and 266% upside.

Table 1:

*All prices are in Australian dollars at a conversion from USD of 0.80. These values are slightly overstated because of the increased distribution costs as Minerva is about 30% further from a port than Yarabee. That said, the difference is more than compensated for when you consider the white mines acquisition. I have also modelled fixed expenses higher than they may well turn out to be.

** This is also about the net tangible asset value per share.

The critical question at this point is why wonÃ??t coal recede to the price in assumption 1. Here are some of the reasons;

Coal, as with most commodities is cyclical. Many argue that we are now in a time of cyclical out performance for commodities as a result of the under investment over the last 20 years or so. Regardless, the 20 year low in the data I have been using (1981-1998 coal prices) is about the same value as the FY 2004 coal prices Felix received. Due to the cyclical nature of coal, its price is mean reverting with a slight downward slope. The mean price is shown in assumption 4 and is far above the FY 2004 price received.

In the end we pay for the energy in coal, gas, oil etc. On a US dollar per Million BTU (British Thermal Units, a measure of energy) basis oil sells at $8.24 (@47.8 per bbl), gasoline sells for $10 per MBTU (@1.24 per gallon), natural gas at $5.90 per MBTU and coal for $2.77 per MBTU ($2.77 per short ton). All prices are from a US commodity exchange in USD as of 2/18/05.

| row 1, column 1 | Cost per | $ per Mbtu |

| 1 barrel(42 gallons) of crude oil = 5,800,000 Btu | 47.8 | 8.24 |

| 1 gallon of gasoline = 124,000 Btu | 1.24 | 10.00 |

| 1 gallon of heating oil = 139,000 Btu | 1.35 | 9.71 |

| 1 cubic foot of natural gas = 1,026 Btu | 0.0061 | 5.90 |

| 1 gallon of propane = 91,000 Btu | 0.75 | 8.24 |

| 1 short ton of coal = 20,681,000 Btu | 57.25 | 2.77 |

| 1 kilowatthour of electricity = 3,412 Btu | 0.05 | 15.17 |

From Table 2 we can see that coal is much cheaper on a BTU basis then all other fossil/ carbon based energy sources. The principle of economic substitution therefore comes into play. Just as average consumers buy more chicken when beef prices rise by 100%, so will energy buyers purchase a lot more coal as oil prices have doubled. There are already natural gas users considering the switch (http://www.hillsboroughresources.com/a-globe000722.html).

It is my expectation that the price of oil will continue to rise as there is now no additional oil supply at much lower prices (there are many sources to support this, search for keyword Hubberts Peak). A long term coal price versus oil price correlation shows about 44% of the coal price is related to the price of oil. As oil becomes more expensive then coal prices will rise also.

While coal is considered a dirty fuel, there are many methods of producing power and energy from coal that produce no pollutants. The sulphur and similar pollutants be can separated by gasification and the carbon dioxide from the burning can be sequestered in underground rock formations. This is the cleanest possible fuel removing around 99% of the pollutants with no other waste materials produced. A power plant using gasification could actually achieve 70 to 80% thermal efficiency up from around 30% today for a traditional coal power station. Traditional plants can be built relatively cheaply and easily unlike coalÃ??s closest competitor nuclear power.

Looking forward to alternative fuels, hydrogen is often mentioned as the fuel of the future. Hydrogen can be produced from coal. In a modern gassifier, coal is exposed to steam and carefully controlled amounts of air under high temperature and pressure. The carbon molecules break down and typically produce carbon monoxide, hydrogen and other gaseous compounds (http://www.cogeneration.net/Coal-Gasification.htm). If only 50% of the energy from coal can be converted into hydrogen, then the hydrogen fuel would cost 50% less on a BTU comparable basis compared to gasoline.

On the supply side, the supply of coal in the US and China is being diverted to domestic markets as energy demand increases and alternatives become more expensive. China used to be a large exporter of coal and is now using most of it for domestic purposes. Additionally there is difficulty getting new mines approved worldwide as environmental standards have become more exacting. Open pit mining produces a very unattractive landscape!

While prices for coal have been so low in the late 90Ã??s and early 00Ã??s, mining companies have deliberately mined their best ore to stay in business. As prices were depressed for so long, many mines now have reserves that contain much less than the average coal quality. Transportation issues are also constraining extra supply. Coal is very bulky with a low energy to weight ratio. Rail lines, at least in Australia, are almost at capacity and ports are operating beyond capacity. This is increasing the cost of existing producers but also constraining additional supply. A similar situation is seen worldwide. Rail providers are looking at forcing coal producers to enter relatively unfavourable long term contracts before they add capacity. Building a new vessel that can carry coal is at least a 2-3 year process and lots of ship building is currently tied up with double hulled oil vessels.

Felix produces both thermal coal and coke. Coke is required to produce steel. According to Ed Yardeni

(http://www.cm1.prusec.com/yararch.nsf/(Files)/t_110703.pdf/$file/t_110703.pdf), China needs to produce a city the size of Houston each month at least up to the 2008 Olympics. Even if China has a hard landing in 2005 or 2006, certain parts of the economy may retrench but it is reasonable to assume that building will continue as the people will continue to move en masse from the country to cities. One report

(http://www.roacoal.com/downloads/lucbohynbali2004.pdf) estimates coke demand from 2003- 2005 would grow by 67M tons (388 M tons of coke were produced in 2003), that is 17% increase. WhatÃ??s more, this report indicates that India is way behind china in steel consumption and China, India and the Former Soviet Union have a long way to go before their steel consumption peaks on a KG of steel per $ GDP basis. Mines are currently overproducing coke versus thermal coal because of the fantastic current prices. In the long run this will reduce the future potential supply of coke.

In the end the case for investment in Felix does not need an increase in coal prices. If todayÃ??s prices persist then there is significant upside. If long term average prices are realized then there is also significant upside. The key driver of the value in Felix is the price of coal which is determined by supply and demand. Demand for coal has many reasons to increase and there are some constrictions around supply in the short to medium term.

There is no analyst coverage of Felix and just finding information about coal stocks is difficult. These are exactly the factors that you would expect to find in a company offered at a great discount.

Felix is traded on the Australian Stock Exchange (ASX) under the symbol FLX, you can get a quote on yahoo using FLX.AX. It is also traded in the US on the pink sheets under the symbol FLRFF or FLRFF.PK . It also seems to trade on the XETRA, Berlin and Frankfurt exchanges, probably on the same basis as the pink sheets in Australia. FelixÃ??s web site is at http://www.auironenergy.com.au/

Archives

April 2003

May 2003

June 2003

July 2003

August 2003

September 2003

November 2003

January 2004

February 2004

March 2004

April 2004

May 2004

June 2004

July 2004

September 2004

October 2004

February 2005

March 2005

April 2005

May 2005

June 2005

July 2005

August 2005

September 2005

December 2005

April 2006

May 2006

June 2006

January 2007

December 2007

February 2008

April 2008

May 2008

June 2008

July 2008

August 2008

September 2008

October 2008

November 2008

December 2008

January 2009

April 2009

May 2009

July 2009

August 2009

September 2009

October 2009

January 2010

February 2010

April 2010

July 2010

August 2010

October 2010

November 2010

January 2011

February 2011

April 2011

June 2011

Disclaimer and Disclosure

Analyses are prepared from sources and data believed to be reliable, but no representation is made as to their accuracy or completeness. I am not paid by covered companies. Strategies or ideas are presented for informational purposes and should not be used as a basis for any financial decisions.

To reduce Spam click here for my email address.