Investing

| Favourite Sites |

Favourite Blogs |

Thursday, June 09, 2011

iSOFT – Using John Paulson’s Merger Arbitrage Checklist

I read John Paulson’s The “Risk” in Risk Arbitrage posted on gurufocus.com via Marketfolly. I filled it away and had the opportunity to use it recently in a merger arbitrage / risk arbitrage on iSOFT (ISF.AX). iSOFT is a medical software company based in Australia with substantial revenues from the UK. iSOFT are partners with Computer Sciences Corporation (CSC) in the NHS Program for IT (NHSPfIT) for the UK National Health Service. I used Paulson’s criteria to evaluate iSOFT and the results were quite positive. I was able to purchase iSOFT shares for 14.5c in mid May which will be about 10 weeks before receiving the cash from the deal for a 17% return. This isn’t a perfect deal but it’s pretty close and provides a good demonstration of using Paulson’s criteria. Finally I will run his criteria over a couple of other transactions for comparison.

I came across iSOFT a few years ago as I was reviewing the companies created by or associated with Allco. Allco were a large, leveraged financial services company with interests in property trusts, leveraged buyouts and other primarily financial transactions. In 2008 they went into administration (the Australian equivalent of Chapter 7 bankruptcy). I purchased some bonds in one of their child vehicles called the Allco HIT trust (see a Hug for AHUG) where I nearly made many times my money but ended up making a small loss. At times I also invested in Allco bonds and their Japanese property trust (RJT.ax). Another child company was Allco Equity Partners (AEP.AX) which changed their name to Oceanic Capital Partners (OCP.AX) after Allco went into administration. OCP owned publicly traded shares in iSOFT as well as convertible bonds. They also owned a security company and loan recovery company. They were selling for about half of their net asset value and I purchased a position in OCP. I intended to short the interest in iSOFT to substantially reduce the risk in m OCP holding. However that side of the transaction proved to be too difficult – it’s hard to short Australian shares (a story for another day). OCP have executed a few returns of capital and I’ve made a reasonable return in spite of iSOFT falling from around 90c to around 3c before the CSC takeover announcement. This is a good example of pulling the threads once you find an interesting opportunity and of investing in an opportunity with a wide margin of safety.

After the precipitous drop in iSOFT's performance and share price OCP took over chairmanship of the iSOFT board and were openly shopping it around. They made a deal with CSC for 17c per share. I rarely consider merger arbitrage opportunities because the margin of safety is often missing. In fact the opportunities often look more like picking up pennies in front of a steam roller. The last one I participated in was the Dow - Rohm and Haas opportunity in the midst's of the financial crisis (my error there was taking too small a position – though isn’t it always when the position works out!).

I took the opportunity with the announced iSOFT transaction to develop a merger arbitrage checklist and populated that list firstly with Paulson’s thoughts. He starts by dividing the risk to a merger arbitrage into Macro and Micro risks. For Macro risk you have little risk (risk of loss of capital) where the deal is cash, or stock where you can short the acquirer in proportion. Paulson then describes circumstances where the ratios are not fixed or are otherwise complicated. I’ve nominated cash deals as the best kind followed by ones with a fixed ratio that can be shorted. Finally on Macro risk it is worth noting that extreme market moves up or down can decrease the likelihood of a deal completing (he notes the 1998 shutdown of the high yield market and the internet bubble of examples each way. We all saw the recent financial crisis where the same occurred). The impact of market dislocations, up or down, is largely about portfolio construction. If your portfolio is neutral then a little market risk from a merger arbitrage position might be fine. If, however, your portfolio is already bullish then you may want to better protect the macro risk downside of this transaction (and of your whole portfolio). If a merger arbitrage position was the only one in your portfolio then you may consider some type of long call, long put strangle that were both substantially out of the money. Other Macro factors can impact a deal if it requires debt finance or the value of the merger is tightly coupled to commodity risks.

Paulson then goes on to Micro risks starting with earnings. The major risk here is that the target has a negative earnings surprise during the announcement-to-closure period. This can lead to the cancellation or renegotiation of the deal (if the agreement allows). Next is financing; cash transactions can come from cash already on the balance sheet of the acquirer or cash that they need to raise in capital markets. Once they need to go to capital markets you have all those macro risks come back into play. There is also a risk in a sudden decline in the earnings of the acquirer as their cost of capital would increase.

Paulson’s next discussion is around legal risks. You need to understand the specifics of the offer, if there are an corporate by-laws that impact the transaction and any litigation that either party is involved in. Another legal aspect is the merger agreement; it is a great representation of each parties’ commitment to the merger. Paulson describes the increasing degree of confidence that you draw from an agreement-in-principal all the way up to a definitive agreement. The degree of due-diligence, performance tests, material adverse changes, drop-dead dates, walk away provisions and regulatory hurdles all impact the likelihood of completion. Regulatory hurdles include anti-trust or speciality government watchdogs such as those that exist for national security, banking etc can kill a deal. Due diligence allows the acquirer to look over the company in detail; if this occurs post agreement then it allows the acquirer to exit the agreement if they find something they don’t like (or for practically any reason).

The Acquirer is the party purchasing the target. The amount of cash on their balance sheet, their capital structure and their deal history is very important. Is it possible that the acquirer is going to in turn receive a buyout offer? Be especially careful if you’re short the acquirer in a stock transaction and consider put options to hedge that risk. Fraud is a consideration but no different to the considerations in being long any stock.

There is then a discussion of return and how premium, taxes, the consideration (cash, stock or other) and timing effect your return. The summary is to consider the after tax return. In comparing multiple opportunities it’s also useful to calculate the annualized return by comparing the after tax return to the period in which it is earned. Be careful though not to call a 10% return in one month a 120% annualized return (excluding compounding) because you need 12 of them back to back for you to actually realize that 120%.

Paulson then presents a list of the types of opportunities to focus on and those to avoid:

| Focus | Avoid |

|

|

Let’s compare iSOFT to the list:

- Definitive Agreements – CSC and iSOFT have entered a definitive agreement that doesn’t have any clause allowing CSC to withdraw from the deal except in the most unlikely of circumstances (iSOFT default, iSOFT material litigation or iSOFT's customer contract termination and even then it has to have been omitted from the due diligence process) (+)

- Strategic rationale – iSOFT are the software provider under NHSPfIT but CSC do the implementations. It makes lots of strategic sense form CSC to own the software as well as deploy it. CSC are quoted saying "Our decision to acquire iSOFT is independent of any specific transaction, client or contact. It's a strategic acquisition that's in line with our global expansion plans." (+)

- Large acquirer – CSC are a USD 5.8Bn market cap company and this deal, including the assumption of debt and repayment of convertible securities, is worth around 500m. (+)

- No financing condition – there are no financing conditions and CSC has 1.84Bn in cash on their balance sheet (gross, not net, of debt) (+)

- No due diligence condition – The due diligence was undertaken before the merger announcement (+)

- Solidly performing target – iSOFT's performance has been poor. Two years ago the shares were around 90c. Their cost structure is far too high for their revenue streams and they have costs in the ever increasing Australian Dollar whereas substantial revenue from the falling British Pound. (-)

- Reasonable valuation – iSOFT traded for 90c two years ago. It is a major player in clinical software and without CSC’s offer they may not have been able to pay off debt as it came due. It is likely that CSC have paid a distressed valuation for iSOFT. By the same token it was trading for 3.5c before the announcement so both sides are getting something of value. (+)

- Limited regulatory risk – Though this was unlikely to receive regulatory scrutiny it has already passed the foreign investment regulatory review. (+)

- Agreements in principle – No it’s definitive (+)

- Deals subject to financing – No (+)

- Deals subject to due diligence – No, conducted before the agreement (+)

- Targets with poor earnings trends – Yes, see above (-)

- Targets with negative earnings – Yes, see above (-)

- Deals in cyclical industries – No (+)

- Deals in highly regulated industries – No (+)

Leading to a total of 12 positives and 3 negatives. It’s also worth noting that CSC have a long deal history and a reputation that they want to maintain in the market. When creating your own merger arbitrage checklist you should think about other factors that come into play in addition to those in Paulson’s list. I found a few more in his commentary such as deal history and have added a few that you would want in any company that you take a long position in such as a clean audit report.

By way of comparison I invested in another Allco related entity which I wrote about in AHUG a good value investment. That deal met only 6 positives and had 9 negatives. There were other potential upside surprises which made it more attractive. While it went ahead it was at a substantially reduced price leading to a loss. Running the “Dow – Rohm and Hass merger” over the list leads to 11 positives and 4 negatives (based on my recollection of the situation). That deal went through as originally envisioned.

With a limited sample, along with Paulson’s track record, it appears that this is a useful tool in analysing merger arbitrage opportunities.

Saturday, April 16, 2011

Deliberate Practice – How to become an Expert

I’ve been reading Malcolm Gladwell’s Outliers. One of the key themes of the book is that experts in a field became experts through 10,000 hours of deliberate practice. There are numerous academic papers that support this view including The Role of Deliberate Practice in the Acquisition of Expert Performance.

[this article] explains expert performance as the end result of individuals' prolonged efforts to improve performance while negotiating motivational and external

constraints. ... Individual differences, even among elite performers, are closely related to assessed amounts of deliberate practice. Many

characteristics once believed to reflect innate talent are actually the result of intense practice extended for a minimum of 10 years…

For us the interesting question is what would deliberate practice look like for a value investor. Mark Sellers suggested some things that are not in his speech titled “So you want to be the next Warren Buffett? How’s Your Writing?”

- Reading books and magazines – the law of diminishing returns applies once you have the core knowledge and at best this allows you to keep up

- MBA, CFA or CPA – these teach you how to exactly match the market

- Experience – if this were true then the best investors would be in their 70’s

and then he suggests 7 traits that make a great investor and that cannot be learned

- Ability to buy stocks when others are panicking

- Obsessive about playing the game and wanting to win – this often means a hard time maintaining personal relationships

- Willingness to learn from past mistakes

- Inherent sense of risk based on common sense

- Confidence in their own convictions and stick with them even when faced with criticism – this also means no 2% positions, what’s the point

- Ability to use both sides of your brain. It’s not enough to be able to do the math you need to be able to write and think of inventive ways to solve problems. You do need to be able to do the math!

- The ability to live through volatility without changing your investment process

Now Mark believes that these traits are set in your early childhood and by the time you leave school it’s too late to change them. I suspect that Mark is mostly right. These are probably well developed by the time you leave school but with sufficient commitment you could practice your way to these behaviours. Of course the the question is would you commit to such a program if you didn’t already have some degree of these behaviours ingrained. If the value investing inoculation worked on you then you probably have what it takes to commit.

So what might deliberate practice for a value investor look like? Tony Schwartz in this HBR article distils the steps required to be an expert into these six steps:

- Pursue what you love

- Do the hardest work first

- Practice intensely

- Seek expert feedback, in intermittent doses

- Take regular renewal breaks

- Ritualize practice

Here are some ideas for deliberately practice towards become a value investing expert

| Deliberate Practice | Not Deliberate Practice |

| Detailing how specific news items may impact your investments

| Reading the newspaper |

| Valuing & evaluating Businesses

| Reading Annual Reports |

| Engage the ideas in books

| Reading Investing Books |

| Engage the ideas and authors

| Reading Articles |

| Manage a portfolio

| Buying and selling shares |

| Writing your own research

| Posting on message boards |

| Be a contrarian

| Buying when the market is doing well or selling when it’s doing poorly |

If you can engage in 20 hours of deliberate practice a week then you’re looking at about 10 years to become an expert. Over that time you would have read around 3,600 annual reports and evaluated around the same number of companies. You would have read 9,000 articles, reviewed 450 personal trading decisions and written around the same number of articles/ research pieces.

Finally the “Dan Plan” describes Dan McLaughlin’s efforts to go from no golf experience to a golf pro using deliberate practice. He’s at about 1,200 hours and so far has only practiced putting. He hasn’t played a single game of golf yet as playing a game isn’t deliberate practice. Buying and selling stocks is not going to make you an expert value investor. Doing the hard work, practicing your analysis skills intently and then critically reviewing your results just might!

Let me know your ideas for deliberate practice (or examples of not-deliberate practice) in the comments!

Sunday, February 27, 2011

Seahawk (HAWK) – The Next Chapter “11”

On February 11th, Seahawk Drilling (HAWK) announced that they were selling substantially all of their assets to Hercules Offshore (HERO). Since the announcement the share price has settled around the mid $4s for a 40% drop. The sale will be conducted through a Chapter 11 bankruptcy to separate the assets from some, unassociated, liabilities. This is a wonderful acquisition for HERO. It may be able to turn HERO’s terminal debt problem into a manageable debt problem. HAWK holders are likely, subject to the long, complex points below, to end up with shares in HERO thereby maintaining exposure to the sold assets. There is a reasonable chance that HAWK holders will end up with HERO shares at least to the value of HAWK’s shares pre-filing. There are some lower probability cases where HAWK holders end up with more than that (assuming HERO’s price is constant around $5) and cases where HAWK holders end up with just a dollar or two.

The treatment of a few key issues is going to define the payout:

| Issue | Negative Outcome (<$2.50) | Most Likely Outcome ($5-$8) | Positive Outcome (>$8) |

| Seahawk’s requirement to cash collateralize the Pride letters of credit | $50M of the estate assets are held in trust to cash collateralize the Mexican tax Letters of credit until the dispute is resolved. | HAWK is relieved of this obligation through constructive fraudulent conveyance. | HAWK is relieved of this obligation through constructive fraudulent conveyance. |

| The treatment of intercompany claims | The worst case here is that the intercompany claims are all treated as unsecured claims. This would leave no money for equity as the intercompany claims dwarf the receipts from the sale. A related, poor outcome is that the intercompany claims rank equally with equity. | The intercompany claims do not result in actual claims. | The intercompany claims do not result in actual claims. |

| The treatment of tax sharing claims against Pride (and Pride against HAWK) | HAWK has to indemnify Pride for all losses incurred as a result of this sale causing Pride to lose the tax free status of the HAWK spinoff. | HAWK is relieved of this obligation through constructive fraudulent conveyance. | HAWK is relieved of this obligation through constructive fraudulent conveyance. |

| The treatment of other claims between Seahawk and Pride | HAWK has to pay Pride 16M of unsecured claims which reduces the payout to equity. | Pride and Hawk net out to zero. | HAWKs claims against PDE add $1-$2 to the payout to equity. |

| The outcome of change of control agreements with key staff (these being separate to severance agreements, the outcome of which are clearer in the code) | Though there is a headline number of $15M of unsecured claims to key staff this appears to be based on early 2010 equity prices. A worst case cash outcome appears to be an addition $4.5M with dilution of around 409k shares. This outcome appears contrary to law. | These are limited to 1 year of salary or around 1.6M plus a dilution of 409k shares | These are limited to 1 year of salary or around 1.6M plus a dilution of 409k shares |

| The outcome of a range of contingent claims such as insurance payouts | It's hard to provide a worst case here but a negative outcome guess is $5M | No idea but let's say these all net out | HAWK has claims including claims against BP for the impact from Macondo. There is some potential positive upside here. Guess is $5M |

| The overall quantity of claims | Aside from Pride and Blake the Trade claims are around $9M. The overall claims are unlikely to be much worse. Guess $13M. There is the possibility of the Hacienda trying to make a claim, though I can’t really see on what basis, research indicates that they would not be successful. | Aside from contingent and PDE claims : $9M | Aside from contingent and PDE claims: $9M |

| Bankruptcy, DIP and Transaction Costs | $12M | $7M | $6M |

| Price of HERO | HERO runs in to trouble with their debt refinancing and heads into liquidity problems. (52 week low = $2.05) | Uncertainty around HERO’s future persists and the stock remains around $5. | This acquisition provides a sufficient capital base for HERO to refinance at acceptable rates. (HERO P/B = Sector P/B = $8) |

Most Likely does not mean that it is likely to occur, just out of all the outcomes it’s the most likely (consider 10 cases each with 9% chance except for the final case which has a 19% chance of occurring. That would be the most likely even though it has <20% chance of occurring).

Brief History

On August 4th 2009, Pride approved a plan to separate into two companies through the spinoff of Seahawk. The spinoff occurred on August 24th, 2009. There are four agreements that define the relationship between Pride and HAWK post spinoff. The Master Separation Agreement, The Transition Services Agreement , The The Tax Sharing Agreement and The Tax Support Agreement.

The combination of the downturn in the drilling market both due to the price of Natural Gas and the de-facto moratorium combined to exhaust Seahawk's liquidity. In November 2010 HAWK announced a process to explore strategic alternatives. Ultimately this process contacted over 100 parties with a view to mergers, acquirers and financial investors. HAWK was interested in an outright sale, sales of certain assets, debt and equity investments. HAWK received their first term sheet on 5th November 2010. Three more term sheets were submitted in late November as the process expanded. The initial term sheet was revised in mid-November but by late November they withdrew. HAWK negotiated with one of the three parties through mid-December 2010. In Mid December an LOI was executed and exclusive negotiations began. HAWK worked exclusively with this company until 21st January 2011. On 20th January HAWK received a substantially revised offer. HAWK rejected the revised offer and suggested that the offer needed to look like the offer in the LOI. On 21st January HAWK received another revised offer that was even worse and HAWK terminated the LOI with the company. Simmons and Company, who were handling the deal, then contacted bidders that had previously shown an interest, with updated data. HERO and one other responded. In February 2011 HAWK’s board entered an Asset Purchase Agreement (APA) with HERO after evaluating the other available offers.

HAWK currently have 7 of their 20 rigs working.

The executed APA contemplates the acquisition by Hercules of substantially all of HAWK’s assets and jackup rigs through a sale pursuant to section 363 of the Bankruptcy Code.

The APA includes the purchase of Rigs, Contracts, Equipment, Vehicles (including leased vehicles), All tangible assets, Accounts Receivable, Insurance Benefits arising from the business (but excluding certain claims), Cash, Prepaid Deposits and Expenses, Claims relating to the business, Permits, Photocopies of all records, warranties, all other assets not excluded.

The excluded assets include The proceeds from the sale, Rigs that are written off, Contracts & Permits that are explicitly excluded, Insurance benefits relating to the sold rigs, Original records, Third party property, Equity interests in subsidiaries, Bankruptcy Claims, Pride Claims, Warranties, leased real property, Software, Trademarks, Websites, Intangibles, Goodwill and other listed excluded assets.

HAWK have secured Debtor in Possession (DIP) financing of $35M of which they plan to draw $25m. Seahawk have received approval regarding the use of DIP proceeds to pay severance to employees terminated within 15 days following the Petition Date as well as incentive payments to non-insider employees under existing employee programs up to approximately $2.0 million in the aggregate.

The outstanding indebtedness under the Revolving Credit Facility is approximately $18.1 million. The Revolving Credit Facility has an initial facility amount of up to $36.0 million. The Revolving Credit Facility is secured by fifteen of HAWKs’ rigs and substantially all of the HAWKs’ other assets, including accounts receivable, spare parts and certain cash and equivalents. It’s important to note, in terms of the fraudulent conveyance discussion later, that 75% of HAWK’s assets could only secure a highly restrictive facility for 36M.

The aggregate consideration for the Purchased Assets is 22,321,425 shares of HERO plus $25,000,012 Cash , subject to certain adjustments. There is a $3M termination fee plus expenses in the event of a termination for reasons such as a better deal for HAWK.

Upon the closing of the sale, the cash portion paid by Hercules shall be used to repay the outstanding principal amount of the debtor in possession financing, various working capital needs and accrued interest and fees due as of the closing date. The Hercules Shares, as the remainder of the consideration for the Sale, will be held in escrow and will be distributed to creditors and interest holders pursuant to a confirmed chapter 11 plan.

Need for Chapter 11

Outside of bankruptcy there is greater risk that a sale of substantially all of a companies assets will inherit some of the liabilities. Another benefit is that certain contracts can be cherry picked and there is certainty around the liabilities that do and do not attach to the sold assets. While they are excellent reasons for conducting the asset sale under Section 363 a Chapter 11 filing also permits the Debtor (HAWK) to challenge certain contracts, that they convince a court to deem as, a constructive fraudulent transfer.

Mexican Tax

Once such contract relates to HAWK’s liabilities for taxes to the Mexican government.

Pursuant to the Tax Support Agreement between Seahawk and Pride, entered into at the time of the Spin-Off, Pride has agreed to provide a guarantee or indemnity in favor of the issuer of any surety bonds or other collateral issued for the account of Seahawk or any of its subsidiaries in respect of the Mexican tax assessments for tax years 2001 through 2004 made prior to the Spin-Off Date, to the extent requested by Seahawk. The Mexican government previously assessed claims for taxes for the years 2001 through 2006 against certain non-Debtor (are not included in the the bankruptcy) subsidiaries of Seahawk.

Reviewing the most recent Pride 10K indicates that HAWK will attempt to have the tax support agreement set aside:

Risk Factors About Our Spin-Off of Seahawk Drilling

Seahawk’s pending bankruptcy proceeding may result in claims against us, the reduction or elimination of amounts owed to us by Seahawk, and termination of our rights to make indemnification claims against Seahawk …

In addition, the bankruptcy laws permit a debtor in bankruptcy, under certain circumstances, to challenge pre-bankruptcy payments or transfers of the debtor’s assets if the debtor received less than reasonably equivalent value while insolvent, or if the transfers were made with the actual intent to hinder, delay or defraud a creditor, or were made while insolvent on account of a pre-existing debt that has the effect of preferring the transferee over the debtor’s other creditors during the so-called preference period. Authorized representatives of the bankruptcy estate could seek to challenge transactions effected in connection with the spin-off under the bankruptcy laws.

In 2006, 2007 and 2009, Seahawk received tax assessments from the Mexican government related to the operations of certain of its subsidiaries. Pursuant to local statutory requirements, Seahawk has provided and may provide additional surety bonds, letters of credit, or other suitable collateral to contest these assessments. Pursuant to a tax support agreement between us and Seahawk, we agreed, at Seahawk’s request, to guarantee or indemnify the issuer …. On September 15, 2010, Seahawk requested that we provide credit support for four letters of credit … The amount of the request totalled approximately $48.4 million, … On October 28, 2010, we provided credit support ... Seahawk’s quarterly fee payment [A fee for the credit support] due on December 31, 2010 was not made, which had the effect of terminating our obligation to provide further credit support under the tax support agreement. Further, on February 9, 2011, we sent a notice to Seahawk requesting that they provide cash collateral for the credit support that we previously provided on their behalf, as provided under the terms of the agreement. In connection with its bankruptcy filing, Seahawk is seeking to terminate its reimbursement obligations under the tax support agreement.

If certain of Seahawk’s claims and requests were granted, the adverse effect on us could be material…

Even though the parties may not have had fraudulent intent, transfers and the obligation to transfer, could be deemed a constructive fraudulent transfer as defined in Section of the bankruptcy code:

§ 548. Fraudulent transfers and obligations

(a)(1) The trustee may avoid any transfer (including any transfer to or for the benefit of an insider under an employment contract) of an interest of the debtor in property, or any obligation … incurred by the debtor, that was made or incurred on or within 2 years before the date of the filing of the petition, if the debtor voluntarily or involuntarily—

(A) made such transfer or incurred such obligation with actual intent to hinder, delay, or defraud any entity to which the debtor was or became, on or after the date that such transfer was made or such obligation was incurred, indebted; or

(B) (i) received less than a reasonably equivalent value in exchange for such transfer or obligation; and

(I) was insolvent on the date that such transfer was made or such obligation was incurred, or became insolvent as a result of such transfer or obligation;

(II) was engaged in business or a transaction, or was about to engage in business or a transaction, for which any property remaining with the debtor was an unreasonably small capital;

(III) intended to incur, or believed that the debtor would incur, debts that would be beyond the debtor’s ability to pay as such debts matured; or

(IV) made such transfer to or for the benefit of an insider, or incurred such obligation to or for the benefit of an insider, under an employment contract and not in the ordinary course of business.

For a transfer/ obligation to be fraudulent it must satisfy 548(a)(1)(B)(i) and one of 548(a)(1)(B)(ii) (I-IV).

At face value Seahawk received no value in exchange for the obligations under the tax support agreement. Tax Support Agreement Section 3.1 – Events of Default:"

Section 3.1 Events of Default. If any of the following events (“Events of Default”) shall occur:

… (h) Seahawk or any of its Designated Subsidiaries shall (i) voluntarily commence any proceeding or file any petition seeking liquidation, reorganization or other relief under any Federal, state or foreign bankruptcy, insolvency, receivership or similar law now or hereafter in effect, (ii) consent to the institution of, or fail to contest in a timely and appropriate manner, any proceeding or petition described in clause (f) of this Section 3.1, (iii) apply for or consent to the appointment of a receiver, trustee, custodian, sequestrator, conservator or similar official for Seahawk or any of its Designated Subsidiaries or for a substantial part of its assets, (iv) file an answer admitting the material allegations of a petition filed against it in any such proceeding, (v) make a general assignment for the benefit of creditors or (vi) take any action for the purpose of effecting any of the foregoing;…

Section 3.2 Events of Default Requiring Cash Collateralization. If any of the following events shall occur:

(a) any Event of Default described in clause (a), (b), (c)(ii), (c)(iii), (g), (h), (i) or (j) of Section 3.1 shall occur; …and in case of any event described in Section 3.1(g) or (h), Seahawk shall forthwith, without any demand or the taking of any other action by Pride, cash collateralize the Aggregate Credit Support Exposure by paying to Pride immediately available funds in an amount equal to the then Aggregate Credit Support Exposure, which funds shall be deposited into the Cash Collateral Account.

Remember that HAWK is under no obligation with Pride to pay the Hacienda. The obligation to Pride is only around cash collateralizing the credit support account. The Hacienda is not going to call on the credit support at this time because the Mexican subsidiaries are not in default (they were deliberately excluded). So the situation is simply that Pride has provided credit support to HAWK so that HAWK could maintain the statutory credit to support an appeal for their tax assessments. Pride offered the support as part of the spinoff as it was contemplated at the time that HAWK may not be able to provide the credit support as a stand alone entity. Which would tend to prove that 548(a)(1)(B)(ii) (III) applied – intended to incur, or believed that the debtor would incur, debts that would be beyond the debtor’s ability to pay as such debts matured - i.e. HAWK would not be able to post the cash collateral because if they could post it then they wouldn’t have needed the Pride credit support.

Worst case HAWK has to cash collateralize the credit support account and 50M worth of cash/ HERO shares go into the credit support account until the Mexican tax issues are resolved which could be a very long time in the absence of a settlement. If the requirement to cash collateralize is set aside then Pride’s credit support stands. Pride doesn’t have an actual loss that they can claim against HAWK here because the Hacienda have not made a claim against the credit support. If the credit support was deemed to be a constructive fraudulent transfer then the credit support fees may also be set aside. It was foolish of Pride to not provide support to HAWK until August 2011.

Tax Sharing (losses incurred by Pride due to the loss of tax free status from the spinoff)

Similarly HAWK is responsible for covering any and all Taxes that arise from certain actions. Under the terms of the Tax Sharing Agreement:

“in the event that the Spin-Off and/or certain related transactions were to fail to qualify for tax-free treatment, Seahawk would generally be responsible for 50% of the tax resulting from such failure. However, if the Spin-Off and/or certain related transactions were to fail to qualify for tax-free treatment because of certain actions or failures to act by Seahawk or by Pride, the party taking or failing to take such actions would be responsible for all of the tax resulting from such failure. “

The Asset Purchase Agreement with HERO is a restricted action. In the Tax Support Agreement SECTION 8:

Restriction on Certain Actions of Pride and Seahawk

8.1 General Restrictions. Following the Effective Time, Seahawk shall not, and shall cause the members of the Seahawk Group not to, take any action that, or fail to take any action the failure of which, (i) would be inconsistent with the Internal Distribution qualifying, or preclude the Internal Distribution from qualifying, as a tax-free transaction …

8.3 Certain Seahawk Actions Following the Effective Time. … during the two-year period following the Effective Time, Seahawk shall not take, nor enter into a binding agreement to take, any of the following actions: (i) sell all or substantially all of the assets … (iii) transfer all or substantially all of the assets that constitute the Seahawk Business as of the Effective Time …

in each case, without first obtaining and delivering to Pride at Seahawk’s own expense a Supplemental Tax Opinion with respect to such action, or a suitable form of financial security issued by a Permitted Financial Institution, in such form and on such terms as Pride may reasonably direct, and of a sufficient amount which Pride may determine in its sole discretion to cover any and all Taxes that may arise as a result of taking such action.

This appears to be a similarly unreasonable obligation and HAWK may try to have it set aside. Pride notes in their 10k:

If certain internal restructuring transactions and the spin-off of our mat-supported jackup rig business are determined to be taxable for U.S. federal income tax purposes, we and our stockholders that are subject to U.S. federal income tax could incur significant U.S. federal income tax liabilities.

Certain internal restructuring transactions were undertaken in preparation for the spin-off of our mat-supported jackup rig business in 2009. These transactions are complex and could cause us to incur significant tax liabilities. We received a ruling from the Internal Revenue Service that these transactions and the spin-off qualified for favorable tax treatment. … If any of these are incorrect or not otherwise satisfied, then we and our stockholders may not be able to rely on the ruling … and could be subject to significant tax liabilities … if the spin-off should become taxable … including as a result of significant changes in stock ownership after the spin-off or the proposed purchase of Seahawk’s assets in its pending bankruptcy proceeding.

Intercompany Claims

There are $387.6M in intercompany claims noted in HAWKs’ filings offset by intercompany Receivables of $194M. The majority are owed to Central American Drilling and Peninsula Drilling, HAWK subsidiaries that are not included in the Chapter 11 filing. There is insufficient detail to determine the nature of the intercompany claims. To the extent that the wholly owned, non bankrupt subsidiaries, do not assert a claim then there is no issue.

Employee Contracts

Normally in a bankruptcy severance is paid out at no more than 1 years salary.

§ 502. Allowance of claims or interests

(a) A claim or interest, proof of which is filed under section 501 of this title, is deemed allowed, unless a party in interest, including a creditor of a general partner in a partnership that is a debtor in a case under chapter 7 of this title, objects.

(b) Except as provided in subsections (e)(2), (f), (g), (h) and (i) of this section, if such objection to a claim is made, the court, after notice and a hearing, shall determine the amount of such claim in lawful currency of the United States as of the date of the filing of the petition, and shall allow such claim in such amount, except to the extent that—…

(7) if such claim is the claim of an employee for damages resulting from the termination of an employment contract, such claim exceeds--

(A) the compensation provided by such contract, without acceleration, for one year following the earlier of--

(i) the date of the filing of the petition; or

(ii) the date on which the employer directed the employee to terminate, or such employee terminated, performance under such contract; plus

(B) any unpaid compensation due under such contract, without acceleration, on the earlier of such dates;

Based on 2009 Numbers that is 1.64M.

| Randall D. Stilley | $ 649,038 |

| William C. Hoffman | $ 138,462 |

| Steven A. Manz | $ 311,538 |

| Alejandro Cestero | $ 295,962 |

| Oscar A. German | $ 249,231 |

| Total | $ 1,644,231 |

Though the claims for cash are probably limited as above there are also change of control provisions that impact options and restricted stock units. For key employees, options are supposed to be modified to provide at least three additional years outstanding and restricted stock units are to be paid in full after a change of control. Assuming complete dilution from these terms an extra 643k shares would be issued. The HAWK 10K indicates the options strike price is around $25. The 409k restricted stock units will likely be issued. The “Notice of proposed interim DIP Financing budget” notes approximately $15m of “payments for change of control agreements”. The Def14-A issued around March 31, 2010 notes around $15m in total compensation for key employees in the event of a change of control. I think this is the basis for the number in the “budget”. In fact, the options component is worth zero, the restricted stock were valued at $22.54 in the proxy filing and the cash compensation will be reduced through the bankruptcy (which based on the table above would be adjusted to $650k for Stilley down from 2.5M in the proxy). Making similar adjustments for all the key employees sets the cash liabilities at around $1.65M and dilution of around 409k shares.

It’s worth noting that Stilley is not doing particularly well from a Chapter 11 filing and most of the value he is going to receive will be as a result of returns to equity. Alignment is always good!

Trade Creditors, Pride Claims (and Counterclaims)

There are around $25.7M worth of trade creditors. HAWK has stated that they plan to pay them in full except for Pride; $16.7M of this is owed to Pride:

Risk Factors About Our Spin-Off of Seahawk Drilling …

In August 2009, we completed the spin-off of Seahawk, which holds the assets and liabilities that were associated with our mat-supported jackup rig business. In February 2011, Seahawk and several of its affiliates filed for protection under Chapter 11 of the Bankruptcy Code. In the bankruptcy filings, we were listed as Seahawk’s largest unsecured creditor with a contingent, disputed, and unliquidated claim in the amount of approximately $16 million. The debt was listed as a trade payable, subject to setoff. … Prior to the commencement of the bankruptcy, Seahawk indicated an intention to seek, among other things, (i) to reject its outstanding contracts with us, thereby replacing Seahawk’s future performance obligations under the contracts with general unsecured claims in the bankruptcy, (ii) to seek a judicial determination or estimation of all of our claims against Seahawk, including indemnity claims and contract damage claims, and (iii) to set off claims Seahawk alleges it is owed for spin-off transition and other matters against all amounts currently payable from Seahawk to us in respect of transition services and rig management services, and to seek to recover any positive balance after such netting.

…As of December 31, 2010, we had a receivable from Seahawk of $16.0 million, net of allowance, which is included in “Other current assets,” pursuant to a transition services agreement and management agreements for the operation of the Pride Wisconsin and the Pride Tennessee in connection with the spin-off.

I have assumed in the “good case” valuation that claims for an against Pride nets out to zero though in the best case it could provide a larger, positive amount. From an equity perspective it doesn’t much matter if the Pride claims are obligations or general unsecured claims as they both rate ahead of equity. The interesting parts are the judicial determination of totals owing and the recovery of a positive balance!

The unsecured creditors committee has been formed and comprises the Pride, Offshore Towing and Dooley Tackaberry. If there were other major creditors it’s reasonable to assume that they would have revealed themselves.

Other Contingent Claims

There is a long list (90) of outstanding litigation matters against HAWK, many relating to personal injury and a few to asbestos. Some of these have been inherited from Pride and may be set aside. The company does not attempt to identify the amounts owing under these claims. There are claims against BP, East Cameron Partners, Blake international and Pride (as noted above) which are listed under contingent assets. The last HAWK 10Q notes:

We are routinely involved in litigation, claims and disputes incidental to our business, which at times involve claims for significant monetary amounts, some of which would not be covered by insurance. In the opinion of management, none of the existing litigation will have a material adverse effect on our financial position, results of operations or cash flows. However, a substantial settlement payment or judgment in excess of our recorded accruals could have a material adverse effect on our financial position, results of operations or cash flows.

Which is the basis for assuming a net position of zero.

Equity Committee

An Official Committee of Equity Holders has been formed comprising MHR Fund Management, Seadrill Americas, Hayman Capital, HSBC Distressed Opportunities Fund and The Keffi Group. Seahawk made a limited objection noting that they were still responsible to act for the equity and requesting that the Equity committee have a limited scope. The order granted by the judge does not limit the equity committees scope. The main areas of disagreement will likely be around key employee contracts. Aside from that, management and equity holders are quite well aligned.

Value of HERO

I haven’t taken the time to do a valuation of HERO. With an improvement in drilling and this terrific deal a price to tangible book equal to that for the sector seems achievable for a price of $8. Their large debt load provides substantial leverage to an improvement in the shallow drilling situation. It also provides leverage to the downside. As noted in the conclusion an increase in HERO to $8 makes it extremely likely that HAWK equity holders will do better than the pre-petition price and possibly a lot better.

Conclusion

Good case, claims senior to equity consume around $35m and 10m of that is met from HERO shares. The rest of the HERO shares are distributed to HAWK holders to the value of around $8 at today’s price for HERO. A bad outcome would require payment to Pride of their trade debt along with cash collateralizing the letters of credit. This leaves around $2.50 for equity holders plus an interest in the eventual outcome of the Mexican tax dispute. An increase in the price of HERO to around $8 substantially improves both cases to around $13.50 for the good case and $8.10 for the poor case. Handicapping the outcomes is difficult. Based on binary outcomes of $2.50 or $8.00 the market is handicapping around a 45% chance of the better outcome. I’d estimate a higher chance than that though I wouldn’t be a buyer or a seller at $5.

Sunday, January 30, 2011

Saturday, January 15, 2011

Eagle Rock (EROC), Kerrisdale and Investment Timelines

I sold out the last of my EROC position in the last few days. I first wrote about EROC in mid July 2009 - Eagle Rock Energy Partners (EROC). I first pegged the value between $7.66 and $8.90 when EROC was trading around $3. In late July 2010 I posted an updated Valuation of Eagle Rock Energy (EROC) post transactions. This pegged a reasonable valuation, based on a weighted average of managements estimates contained in SEC filings, at $9. As EROC is now at around $9.40 I’ve closed all my positions in the stock and warrants.

When EROC was trading at $3 there was a forced seller and a belief that they could violate bank covenants. The forced sellers had purchased EROC for yield and the distribution had been cut to 2.5c per quarter. In reality the bank covenants could not be violated as the company had control over their hedges which provided a backdoor mechanism to remain in compliance. EROC subsequently announced a series of transactions to affect a recapitalization. There was a lot of controversy over the transactions. Kerrisdale Capital launched a site fair-eroc.com to vote down the proposal. Kerrisdale do good work and I bet they have a terrific run rate. However, this time they got it at least partially wrong. Kerrisdale outline their concerns at fair-eroc.com;

“So what remains? In our view, NGP is essentially canceling (sic) its subordinated units in exchange for $29mm (plus associated rights/warrants if they receive the fee in shares). These subordinated units are not worth $29mm+. With $1.65+ of arrearages ahead of them, the subordinated units will be underwater for 5+ years. We at Kerrisdale believe they are worth very little.”

In fact they were worth around $40M. I contacted Kerrisdale about their methodology for calculating the value. They had not calculated a value for those units but held a belief that the value was so far in the future that the uncertainty would wipe out all the value (sounds like an option doesn't it!). I calculated an undiscounted cashflow of nearly 400M and a discounted value of $40m. EROC was paying $35.5M for them. Kerrisdale did manage to bring about some minor changes in the plan and I appreciate their efforts to put management on notice.

As a result of the initial offer I valued EROC at $8.58 which was then updated by a few percent after the revised transaction was announced.

In Kerrisdale’s 8/10/10 post on their activism efforts (login required) they note

“In the end, however, unitholders voted in favor of the plan. We’re not exactly sure why – the restructuring was clearly less than ideal, and we’re confident that NGP would have sweetened the offer if holders had rejected the initial proposal.”

The answer may lie in Behavioural finance. There is a famous experiment called the Ultimatum Game in which two volunteers participate. “The first player proposes how to divide the sum between the two players, and the second player can either accept or reject this proposal. If the second player rejects, neither player receives anything. If the second player accepts, the money is split according to the proposal. The game is played only once so that reciprocation is not an issue”. In many cultures a 50/50 split is offered and an offer below 20% is usually rejected. The most economically rational decision is to keep $19 and offer $1. The 2nd volunteer is still $1 better off but a 19/1 split is usually rejected. In this case NGP developed a proposal that offered value far from 50/50 but probably at around the 80/20 line (80 to NGP of course!). The reality was that EROC holders were offered incremental value, just substantially less than the value to NGP. Kerrisdale may well be right that NGP would have come back with a better offer but the offer on the table was accretive to shareholders.

At $9.39 there are a number of risks to EROC. Natural gas prices, interest rates, refinancing and capital investment risk. There are lots of ways EROC could be worth less than $9.40 and far fewer ways that it could be worth substantially more.

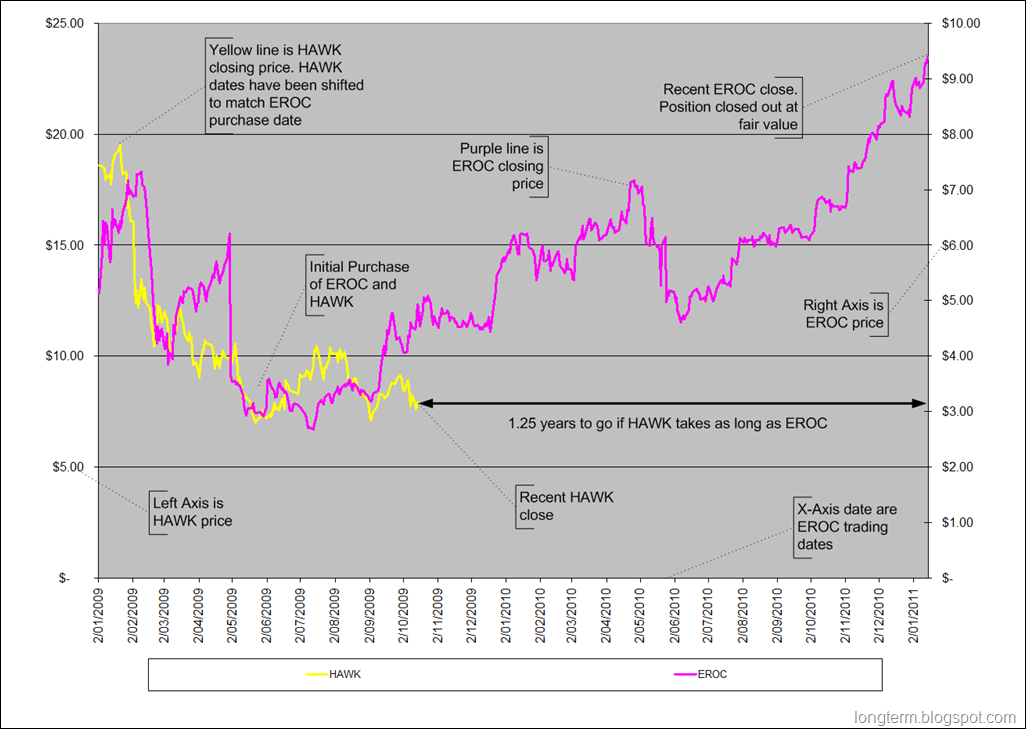

Finally, as this seems to have turned into the Seahawk (HAWK) blog it’s interesting to note the EROC timeline with a Seahawk overlay. The Seahawk closing prices are shifted to match my initial purchase of both HAWK and EROC.

If HAWK takes as long to play out as EROC then there are still 15 months to go. I have no particular insight that this is an appropriate timeline. However, if your timeline is substantially less than 1-3 years then you are unlikely to see this play out before you (have to) close your position.

Saturday, January 08, 2011

Purchasing Power Parity Valuation for the Australian Dollar 2011

I first wrote about the Australian Dollar PPP in October 2008. The AUDUSD had fallen to .62 on it’s way to .61 a couple of days later and was 40% undervalued (all over/under valuation is compared to USD). The crux of the October 08 post was to invest in AUD assets at that time because there was a substantial headwind in other currencies if your base is in AUD. Similarly in other currencies you had the chance to be buoyed by AUD appreciation. The work was based on the Economist Big Mac index. There is substantial research that a few simple metrics often out perform larger models and Purchasing Power Parity (PPP), the idea that representative goods should trade at similar prices world wide, makes sense. There was a belief in Australia, in late 2008, that the AUD was going to keep falling. I had dinner around Christmas in 2008 and discussed this with an IT company CEO and a senior manager at an international oil company. They both thought an appreciation of the AUD was quite unlikely; they were wrong and PPP was right.

Where are we now

John Hempton of Bronte Capital, a blog I strongly recommend, has noted “And early is wrong. At least if you are an Australian and you took your cash offshore at 80c or less to the USD.”. Today the AUDUSD is 1.0 with a high of 1.03 reached recently.

The October 2008 list of major countries who’s currencies were more undervalued than Australia’s was;

- South Africa

- Malaysia

- Hong Kong

- Philippines

- Thailand

- Indonesia

- China

Now It’s somewhat larger!

| 30-50% under

| 0-30% under

| 0-13% over

|

The Australian Dollar is now 16% overvalued compared to the 40% undervaluation in October 2008. Hong Kong and China are still nearly 50% undervalued. The Euro, Canadian Dollar and the Australian Dollar are all 10-20% overvalued with the Yen at around purchasing power parity.

An Insurance Trade

The Australian dollar has an excellent track record of falling to greatly undervalued levels in times of crisis. This is very supportive of insurance trades from current AUDUSD levels. The table below shows the AUD P&L for shorting a hypothetical US index in USD where your record currency is AUD. The trade is

- Short Index

- Receive USD Cash

- Buy back index

- Convert USD Profit or Loss in to AUD

| AUDUSD | Index=100 | Index=50 | Index=150 |

| 1 | 0 | 50 | -50 |

| .6 | 0 | 83.33 | -83.33 |

| 1.4 | 0 | 35.71 | -35.71 |

In the case where global markets fall and the AUD falls your gains are magnified. In the case where the AUD keeps rising and the US market keeps rising the losses are diminished. The risk in this trade is where a very country specific event happens to Australia causing the AUDUSD to fall and the US market still has a substantial rise. In that case your losses are magnified. Of all the cases, this one is relatively unlikely and as an insurance trade there is potential for the losses to be offset by your gains. I'm not proposing this is a great outright trade, only that it’s great insurance with a free kicker that grows when you most need it.

Hong Kong Dollar

Jim Grant has an excellent discussion of opportunities in Asian currencies and especially ways to profit from an eventual rise in the HKD, in his free summer break Vacation Delectation from August 2010, under the heading “Three-dollar tale”.

“In preview we expect the Singapore dollar to appreciate and the Hong Kong dollar to appreciate-or, just possibly, to depreciate. Holding a certain kind of currency option, one would be paid in either case”.

“Or taking an agnostic view you could buy a strangle with strikes set 10% out of the money on either side,…, two years out for 33 basis points”.

Jim has done a better job than I ever could describing the situation and the trade he proposes has an excellent risk reward. I favour a substantial appreciation of the HKD over time but as both Jim Rogers and Jim Grant point out, the short term direction, on revaluation, could go anywhere. I wrote about REIT investments in Singapore and Hong Kong in July 2008. I made some investments and the subsequent drop in the AUD diminished the losses. Prosperity REIT was trading at HKD 1.5 in July 2008 when I wrote about it or .20 AUD (AUDHKD 7.50). By January 5th 2009 it was trading at 97c or 18c AUD (AUDHKD 5.50). The loss in HKD was 35%, in AUD only 10%. It closed today at 1.79 HKD and has paid 5 dividends totalling .30 since for a total return of 40% in HKD – not bad for a REIT (current AUDHKD is 7.74 so the AUD returns are 35% or 15% annualized). Receiving 15% a year while you wait for a revaluation isn’t bad but Jim’s trade is $0.33 to make $40 best case, if PPP is reached within 2 years!

Portfolios with AUD (CAD or EUR) base currency

This is a sound time to investing in USD assets and an excellent time to invest in HKD denominated assets. Cheap assets, of course, as always! With the HKD you get all the insurance benefits of a USD investment and the potential upside of a currency revaluation. It’s also a good time to re-orient portfolios out of your home country because the headwinds have moved there. This applies to the Australian Dollar, Canadian dollar and to a lesser extent the Euro.

Wednesday, November 10, 2010

Seahawk (HAWK) Strategic Alternatives

Seahawk announced earlier this month that they had engaged Simmons & Company International to explore strategic alternatives. “These alternatives could include, but are not limited to, transactions involving a sale of assets, a recapitalization, or a sale or merger of Seahawk.” While there could be many options I want to lay out a proposed capital raising that would raise $54m, be fair to current holders that did not participate and provide current holders with the exclusive right to participate.

The scheme would allocate 5 options and 1 ordinary share for $10.19 to each subscription right. Current holders would be offered this on the basis of .45 subscription rights for each current share. The subscription rights would be tradeable as would the options once issued. The scheme would allow oversubscriptions from current holders in proportion to their subscription rights. If the maximum amount of $54m was not raised then the offer could be extended to non-current holders.

The options would have a strike price of current $20 which would be $17.21 after the capital raising and a 5 year expiry. The share price should not fluctuate immediately after the capital raising because the shares would have been issued at the current price. The new market cap would be 175M (current market cap plus new cash) and there would be 17.2M shares outstanding up from 11.9 today.

The returns from participation are shown below. Note that the “no participation” case does not reflect your ability to sell the rights which will increase your returns (potentially up to $4.50 per right). The participation case does not include the time value of the options which should also increase the participation returns (at-the-money with 3 years remaining would have a time value of $1.40 per option).

| Old Price | New Price | No Capital Raising | No Participation & no sale of rights | Participation & exercise of options (not sale) |

| $ 10.18 | $ 10.19 | 0% | 0% | 0% |

| $ 20.00 | $ 17.21 | 96% | 69% | 69% |

| $ 25.00 | $ 18.59 | 146% | 82% | 129% |

| $ 30.00 | $ 19.96 | 195% | 96% | 189% |

$54M would provide about 7 quarters of liquidity at $7M burn per quarter or 5 quarters as $10m. It is quite unlikely that the Q3 experience is going to continue for the next 5 quarters.

Though it’s not very important now, the cash raised from exercising options could be restricted for: repurchasing stock at a discount to book value, repurchasing options at a discount to intrinsic value or a return of capital to shareholders.

Let’s work through the current $20 and current $25 cases.

$20

The market cap indicated by $20 pre-raising is 241M. We add the 54m raised to get 296m. No options would be exercised so there are 17.2M shares outstanding for a share price of $17.21. That would be a 69% upside from current prices after the raising instead of the 96% you would have had in the absence of a raising. Bear in mind that those participants in the capital raising would have at-the-money options which should have some substantial time value (depending on when this occurs).

$25

This case is more complicated because we assume that all options have been exercised (worst case) and the cash is held on the balance sheet. We start with a 356m market cap (current price * 2.5 + cash from raising) and add 459M from option exercise for a market cap of 815M. There are now 44M shares outstanding for a price per share of $18.59. That’s an 82% return for those who did not participate in the capital raising (and did not sell their rights). For those that participated they would make $8.40 from their original shares, $3.78 from their new shares and $3.10 from the options from a total investment of 10.19 (current price) plus 4.58 (.45 * 10.19) for a return of 129%.

So why would you want to participate at $10.19 for 1 ordinary unit and 5 options. Each option is worth around 90c (using an option pricing calculator that includes the impact of dilution) or $4.50 in total for a value of $14.50 per $10 subscription. If you sold the options after issue you would expect to have paid $5.50 for each ordinary share.

This model trades off upside (for those that don’t participate) for a much more certain, lower return; while providing an immediate return for the sold rights (potentially as much as $4.50 per right).

I don’t propose that this is the optimal model but it shows how a capital raising could be structured to be fair, provide substantial upside to those interested in an eventual return to normality and provide the liquidity that HAWK needs right now. Compared to a takeover which would truncate your upside, an underwritten share issue which would greatly dilute your upside or even a discounted rights issue which would reduce the returns to non-participants at all price points (old $20 would return only 30% instead of 69% under this model). It also provides a reasonable baseline to compare future proposals. I’m not suggesting the company should proceed with this model, simply that such a model exists and the challenge for HAWK should be to produce a superior one

Q3 2010 HAWK Conference Call

Management have continued to innovatively cut costs, sell spare parts and broadly behave in a shareholder friendly manner. There are lots of potential upside surprises and not too many ways things could get worse than Q3.

I’m surprised at how much money they’ve spent on the Seahawk 3000 but from a liquidity point of view it makes sense.

The Mexican tax issues continue with no clarity as to the eventual outcome, though HAWK continues to insist that they don’t expect a payout.

The Strategic review was triggered by a deterioration in management expectations since July. There is going to be a liquidity problem in the first half of 2011 and they want to explore alternatives now. They had previously “hoped” to be cash flow neutral by the end of 2010. I never shared management’s optimism though the review creates additional potential upside surprises (albeit with the potential to lock in a smaller, definite, upside such as a sale in the mid-teens)

Below are my notes from the call organized by topic.

Upcoming work

- Seahawk 3000 on contract by 1st week December 55-60k per day for 6 months.

- They think could have 8-9 rigs working by the end of the year.

- 6 rigs under contract, 3 idle, 11 cold stack not including the Seahawk 3000

- “Customers haven't been able to drill in 2010. Could you see a bonanza next year to catch up?”

- That depends on permits. If he could see how many permits issue next year then would know drilling activity. If get back to normal you would think it wouldn't take long to get back to fully utilized rigs.

- US Nat Gas prices have been weak with increased drilling on land. Workovers and re-entry drilling should create increased shallow water demand if permits were issued in a timely fashion. As permitting process improves they expect demand to improve regardless of gas prices. Especially the plugging and abandonment of wells.

- PEMEX will issue tenders for 20 jackups starting in 2011 in addition to 4 short term. 10 for incremental rigs and will likely relax the 10 year age restrictions. Some of these will likely come from us GOM. PEMEX may not require matt supported rigs but Seahawk should still benefit from the supply / demand environment.

- “Randy are you seeing opportunities throughout the world for matt rigs outside GOM?”

- Not a whole lot. There could be some opportunities but they'll be in the same place. East coast India needs a matt rig. For the most part by the time you factor the mobilization costs it's hard to be competitive.

Idle Iron

- 3500 wells and 650 platforms. Should lead to additional demand over next 3 years.

- Applies to wells out of service for 5 years. If there are platforms with no producing wells then the platforms have to be decommissioned along with the pipelines.

- From Oct 20th Operators had 120 days to submit plans to BOEM. 3 years to complete the work. P&A work over and above normal and platform decommissioning.

- “How can this be done with 44 rigs given around 4k wells and platforms?”

- Typical P&A job is 1wk - 10 days.

- Platform may or may not use a rig can use a lift boat.

- “Are any recent contracts for P&A?”

- P&A is still in the future.

- Probably 2Q next year at the earliest.

- 2Q & 3Q most active due to weather.

- The work will be planned out over the 3 years. Actual decommissioning only during 6 months but P&A all year.

- “Is the cost of P&A same as drilling a well?”

- No, some P&A few hundred thousand to 1M. Per day cost is the same.

- “3500 wells need to be plugged, over 3 years. 1200 wells per year. 7-10 days to do the work. 1 rig could do 35 wells in a year. Is that correct?”

- 10 days on outside. Figure on 7 days. Could probably do 52 per year.

- Until they see the plans they won't know how many will require rigs and how many won't require rigs.

- There are other ways, temporary plugs can be done with wireline units. Permanent plug require rigs. Once the plans are submitted they'll know the real demand for the rigs. Much clearer picture early next year.

- (HERO talked about the incremental demand for their liftboats from this work on their call)

Costs & liquidity

- Only 1 idle rig is fully crewed the others are not

- “What is the contingency on the 2505?”

- Contingent on award of drilling contract. Not awarded until early Feb at the latest.

- “Are you looking to stack 1-2 more rigs?”

- The idle rigs are not crewed so it's not so much of an issue.

- “Are you seeing some reasonable pricing gains?”

- Some modest gains or at least holding their own.

- On P&A potential, are operators starting to move? Right now operators are submitting plans. Won't get plans in until early next year. Then 3 years from then.

- In 3rd Q sold some surplus equipment for 900k and received gain on sale of 750k.

- 4Q rig utilization is unpredictable expect 3-7 rigs, operating costs excluding SG&A, Depreciation and Repair costs : 23-25M including $2M of shore based expense.

- “Prepaid expenses and accrued current liabilities, what are the major components?” -

- Prepaids - some of the usual stuff, insurance etc. Any of this one time - no it's ordinary. Not unusual.

- On the accrued expenses and liabilities- some of the repair work on Seahawk 3000, rest of that is ordinary stuff. How much of 46 is repair work, 7m.

- Impairment analysis, no reason for additional write-downs unless they sell more rigs for less than book.

- Repair of Seahawk 3000 $7m in Q4.

- Operating costs 22-26k per day of working rigs.

- Cold stack 2k-3.5k per day per rig as a result of cluster stacking scheme.

- 4Q SG&A $8m-$9m (similar) 2.4M non cash stock comp.

- HAWK balance sheet currently has 41.4M cash , net work 11.4M

- 14.5M payable to pride. Will not pay pride until resolve counter claims.

- Drew down $11.5M revolving credit for Seahawk 3000.

- Actual cash burn $18m.

- Forecast $25M cash burn for 4Q includes $15M paid out for Seahawk 3000. Cash burn assuming current run rates on the current contracts.

Permits and overall industry

- Across the GOM 31 contracted rigs of 44 marketed fleet. Only 27 working due to permit delays.

- 13 new well permits since April 20th. Not optimistic that they’ll get to 15 per month until mid to end next year.

- “What is the permitting process like now?”

- Has improved somewhat.

- Normally picks up in 4Q.

- BOEM is trying to add 200 additional staff.

- Process is now more time consuming than previous approach. Right now optimistic about the direction. By 1Q 2011 should be back to more normal activity.

- Shallow issuance improved in October and they hope to see that continue over coming months

- Most permits issued so far have been workovers and re-entry drilling that did not need to comply with NTL 06

- It seems that a tiered risk format may be implemented for shallow gas wells in the near future to be followed by a similar process for shallow oil wells at a later date. This change would increase permit issuance.

- More detail on tiered risk approach. Generally the approach is to classify wells in tiers of risk, shallow, gas only, area , lower pressure, previously drilled, going to be a low risk well. As you go up, higher pressures, more productive zones, more liquids then higher risk.

Strategic Alternatives

- They recently issued a press release on strategic alternatives. They want to maximize shareholder value. They Continue to believe their strategy is sound and international opportunities are attractive. Everything is on the table not limited to sale assets, sale, merger, recap. Do not plan to disclose developments until board approves a transaction.

- “Why not ride it out as this sounds like the bottom?”

- Still a very uncertain environment. Can't guarantee that the permit process will improve quickly.

- Also have certain liquidity needs that need to address early next year. Prudent to look at alternatives right now to better position the company for the future.

- “Strategic alternatives. What happened that got management to look in to this versus in July/August when that wasn't the plan. What changed in thinking?”

- In summer still more optimistic that the regulatory environment would not be as difficult. In early summer they thought it might get back to early 2010 levels and return to cash positive by end of year.

- It doesn't look like that now. More of a near term issue from a cash point of view. Still optimistic long term domestically. Still like opportunities internationally.

- “International strategy - update on those conversation?”

- A number of rigs looking at acquiring are working rigs with contracts attached. Its more important for a qualified drilling contractor as a buyer as they have contracts.

- “Why not ride it out as this sounds like the bottom?”

Mexican Tax

- 46M unsecured credit from Pride used to replace surety bonds. HAWK is defending their tax position.

- Received an unfavourable ruling on USD $21M.

- HAWK believes court did not take in to consideration key expert testimony and have appealed.

Archives

April 2003

May 2003

June 2003

July 2003

August 2003

September 2003

November 2003

January 2004

February 2004

March 2004

April 2004

May 2004

June 2004

July 2004

September 2004

October 2004

February 2005

March 2005

April 2005

May 2005

June 2005

July 2005

August 2005

September 2005

December 2005

April 2006

May 2006

June 2006

January 2007

December 2007

February 2008

April 2008

May 2008

June 2008

July 2008

August 2008

September 2008

October 2008

November 2008

December 2008

January 2009

April 2009

May 2009

July 2009

August 2009

September 2009

October 2009

January 2010

February 2010

April 2010

July 2010

August 2010

October 2010

November 2010

January 2011

February 2011

April 2011

June 2011

Disclaimer and Disclosure

Analyses are prepared from sources and data believed to be reliable, but no representation is made as to their accuracy or completeness. I am not paid by covered companies. Strategies or ideas are presented for informational purposes and should not be used as a basis for any financial decisions.

To reduce Spam click here for my email address.