Investing

| Favourite Sites |

Favourite Blogs |

Sunday, July 25, 2010

Seahawk Drilling (HAWK)

INTRODUCTION

Seahawk Drilling, spun off from Pride last year, is an interesting opportunity selling at a discount to distressed liquidation value and a substantial discount to orderly liquidation value. HAWK provides jackup rigs in the Gulf of Mexico (GOM) primarily to natural gas exploration and development companies. The stock has become unreasonably cheap as a result of the Macondo blowout in April. HAWK price was 18.80 on the day of the spill and has fallen to 9.97 today, following BP down, even though the value of HAWK is mostly unrelated.

Stocks that trade at a discount to liquidation need to have a few factors acting against them. HAWK has plenty, though very few of these have changed since the Macondo blowout:

INDUSTRY

PRE-SPILL

* Competitors such as Hercules Offshore (HERO) are heavily indebted and when bidding are willing to sacrifice profitability for cashflow

* Shallow water GOM mostly produces Natural Gas, therefore interest in their rigs is tied to Natural Gas prices which are trading at very low levels so NG explorers are not exploring

* They operate in shallow water which may have been substantially explored and is likely in permanent decline

* Their rigs are old (Mat Cantilever and Mat Slot) and some customers like PEMEX have recently tendered for strictly newer rigs with higher specifications (Such as Independent Leg Cantilever)

* The matt supported rigs are only really suitable for the GOM and transport costs for Jack up rigs are very high so moving them is not generally an option though Hercules placed a mat-supported jackup off the coast of Malaysia in 2008.

* There are some new rigs coming on to the market and HAWK, as well as their competitors, have a number of rigs “cold stacked” (no crew on board and no maintenance)

* The market for used jackup rigs have reverted to 2004 levels having doubled since 2004 and fallen again

* The business is intensely cyclical

* It is no longer possible to insure 100% of liabilities for certain events such as hurricanes in the GOM and the insurance you can get has substantial deductibles

CHANGED AS A RESULT OF SPILL

* The industry recently turned up from a cyclical low only to be hit by the oil spill in the Gulf of Mexico (GOM)

* Though the government has not banned shallow water drilling they have added new permitting requirements. They do not appear to be onerous and some permits have been issued in the last few days to HAWK. It is unclear how long it will take to get back to a normal permitting level though the company believes it’s likely to add a few thousand dollars of costs per permit (generally once per well) and is primarily an issue of paperwork and certifications.

COMPANY

PRE-SPILL

* HAWK is responsible for damage caused by one of their ships during a hurricane, some (or maybe all) of which is covered by Pride’s insurance.

* Tax dispute with the Mexican Government

* They have lost money since the spin-off from PRIDE and though they have cash it won’t last forever. They are cash flow negative with around 6 months worth of cash on hand (all things being equal).

* Their credit rating, based on a simple credit scoring model, is very poor, though they have substantially no debt. This is reflected in the onerous security that their revolver has over 15 of their rigs.

* Pride are conducting an investigation into bribes paid by the precursor to HAWK which may end up subjecting HAWK to some consequences

* For two years after the spinoff (24-Aug-2009) they cannot sell substantially all their assets (liquidation) or issue shares due to the tax agreement with PRIDE (with some exceptions)

* The CFO recently retired after only a short time with the company (he joined pre spinoff and left post spinoff).

* The executive team is new and the CEO, who came from Hercules, was responsible for a large loss due to a bad acquisition at Hercules

* SG&A costs are unreasonably large at 48% compared to 8% for HERO (HERO has a 6 times larger revenue base and much of HAWK’s SG&A is related to cold stacked rigs).

* It is very difficult to determine the performance of the company while it was still part of PRIDE as the numbers are not effectively broken out.

CHANGED AS A RESULT OF SPILL

* Share price is near an all time low

With that rather large list of problems you’d need a great reason to be looking at HAWK. They include:

INDUSTRY

* The economics of drilling in the gulf discourage new entrants and fleet additions. Day rates for new $200M rigs would fetch about 100k versus day rates for old $20M rigs fetching 40k per day in the GOM. These new rigs can earn higher returns elsewhere while the matt supported jackups are unsuitable for most alternate locations. There were about 130 rigs in GOM in 2000, today there are closer to 30. At some point supply and demand will be in balance, mid-cycle demand may already exceed supply.

* Though there are 40 jackups under construction and 13 more on order, none of these new rigs are likely to enter the GOM because of the economics (100k per day for a 200M rig) and an inability to secure windstorm (hurricane) damage insurance.

* Competitors are leaving the gulf and are unlikely to return due to economics, legal liability, requirement for US crews, etc. This reduces the total available rigs. In the last few days there was an announcement of two Rowan, high spec, rigs leaving the GOM for the Middle East (http://www.reuters.com/article/idUSN0114280720100701).

* There are only about 15 cold stacked jackup rigs that are ready for service in the GOM of which HAWK owns 8. An additional 10 rigs would be required to return to January 2009 levels. The other 15 cold stacked rigs require substantial capital expenditure before they would be ready, of which HAWK owns 2.

* Requests for shallow water bids have increased 60% since this time last year (pre-BP spill). Exploration budgets for operators that include GOM are up an average of 22%

* The freeze on deep water drilling in the GOM may drive up crude prices substantially thereby increasing the spread between the BTU equivalent price of natural gas and crude oil. Some applications can switch to natural gas and the extremely cheap gas can be locked in using futures markets thereby supporting the capex to switch and creating additional demand for gas. The freeze may also drive some exploration to shallower water.

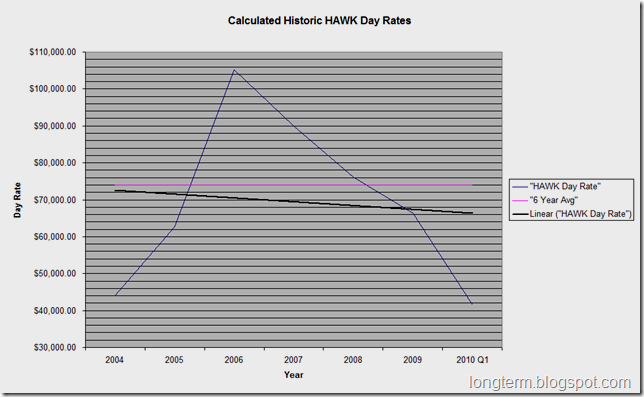

* Q1 2010 day rates are back at 2004 levels with 75% upside to a 6 year average.

COMPANY

* HAWK is trading at about 25% of book value, HERO trades at 28% of book with 872M of debt versus 325M of equity. HAWK has substantially no debt (6.4M in short term debt versus 35-45M in cash today).

* Trading at about 32% of Fleet Market Value as calculated from third party sources including appraisals

* Trading below the price you’d receive for liquidating their business and selling their fleet for scrap. This is the distressed liquidation value.

* They expect to end June 30th 2010 with 35-45M in cash. They are currently losing about 15M in cash per quarter based on the Q1 rig rates so all thing being equal they have about 6-9 months of cash on hand.

* There is an opportunity to secure work with PEMEX (Mexico's state-owned petroleum company). PEMEX’s premier field, Cantarell, is in substantial decline and one way to offset this is to spend substantially more on exploration. There are 18 jackups coming off tender with Pemex and to support their 2010-2014 business plan they may need closer to 40 (there are only 30 cold stacked rigs in the GOM, including those that require substantial capex to restart).

* The tax dispute between HAWK and the Mexican Government is with HAWK subsidiary companies which have no assets. Mexico recognizes the concept of limited liability in a company and even if it finds HAWK guilty is unlikely to be able to call on the parent company assets.

* Restricted stock grants to management have occurred at much higher prices and there are 350k options outstanding at a strike price of $26.

* The top 5 executives own $16.7M of stock, restricted stock and options valued at issuance. These are worth about $7M now or 6% of shares outstanding.

* The CEO had his employment agreement amended to take his salary from mid June to end of December 2010 as shares (restricted stock units - RSUs) and no cash, all 31,000 shares issued at the June 25th price. Non employee directors are receiving shares (RSUs) as their fee from April through December. They are both taking their balanced compensation in stock rather than cash as well.

VALUATION

Valuing HAWK is easy once you have inputs. The complexity is in developing mid cycle (average) inputs.

A company with negative cash flow eventually does one of two things; becomes cash flow positive or insolvent. By considering a whole cycle of rig day rate prices it is possible to calculate an average day rate to determine HAWK’s earning power. HAWK does not have rig rate history all the way back to 2004 so I've overlayed HERO (Hercules) rates by using the ratio for overlapping dates and apply the same for the missing ones.

|

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 Q1 |

| HAWK Day Rate | $ 43,947 | $ 62,711 | $ 105,155 | $ 89,964 | $ 76,117 | $ 66,400 | $ 41,600 |

| HERO Day Rate | $ 37,210 | $ 53,098 | $ 89,035 | $ 78,456 | $ 66,672 | $ 52,649 | $ 35,191 |

I’m going to use 68k as the mid cycle revenue per rig which is the best fit over the prior cycle. The average over the prior cycle is 74k but the 68k is a reasonable proxy for the gradual decline of the offshore GOM drilling industry (the suggested decline -line of best fit- is about 1k or 2% per year). Assuming the number of rigs is constant at 8 then the change in EBITDA is +82M at the 6 year average rig rate. Annual Q1 EBITDA is around –80M which would leave HAWK at breakeven.

Based on the utilization sourced from RigZone (http://www.rigzone.com/news/article.asp?a_id=94392)

70% is a fair mid cycle utilization rate which is 14 rigs. This is supported by the fact that Hercules has been able to deploy their entire fleet in peak times.

With a 70% utilization rate and 68k rig rate, using the incremental EBITDA table provided by HAWK

(http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9NTA1MjV8Q2hpbGRJRD0tMXxUeXBlPTM=&t=1), mid-cycle EBITDA would be about 85M (-80+165) for a mid-cycle EV/EBITDA of about 0.7 using end of Q2 2010 EV!

Further assuming that HAWK runs off their current assets and then liquidates with no residual value after 10 years they’d be worth about $32 using a discounted cash flow valuation. This doesn’t include a possible increase in rig rates because so much supply is permanently leaving the gulf or the scrap value at the end of 10 years.

BOOK, APPRAISED AND SCRAP VALUE

Book value for HAWK is $433M or $36.50 per share. This values their average rig at $21M. Using current rig values and some appraisal data, HAWK value their fleet at $377M, $32 per share and $18.9M per average rig.

The company asserts that current valuations around $20M are supported by an appraisal from Bassoe and “Jeffries Offshore Drilling Monthly”. It's also supported by a few transactions, albeit in an illiquid market.

The current market price of $9.97 values each of their rigs at around $5.3M.

There is excellent support for a distressed liquidation value in excess of $5M per rig. HERO entered contracts to sell two _retired_ Jackups that had been in long term cold storage for $5M each, essentially for scrap value. However bad things are in the GOM, steel prices are still doing just fine. One of the HERO rigs was a 1977 250ft which closed in April 2010 and the other is a 1978 160ft scheduled to close in Q2 2010. These rigs required substantial capital expenditure to re-enter service. These are similar to the HAWK rigs except that most of the HAWK rigs (18 of 20) have not been in long term cold storage and do not require more than 1-2M to get back into service. HAWK asserts that they would get far more from a liquidation of their rigs as the equipment on the rigs has substantial value before the steel is harvested. HAWK asserts the value is above $8M per rig.

| Method | Price Per Share | Likelihood | Appreciation |

| Book value | $36.50 | Low | 266% |

| Realisable asset value | $32 | Reasonable | 221% |

| flow and rigs | $32 | Reasonable | 221% |

| Scrap Value + net assets | $10.50 | V.low | 5.3% |

DOWNSIDE

Finally it's worth looking at the downside. Most of the downside comes from the company consuming the current value by converting assets in to cash in the hope of better times ahead. Assuming a reasonable worst case that HAWK have to cold stack all of their rigs and then sell down assets to pay for the fees; then HAWK's net asset value would equal today's market cap by Q4 2012 (11 quarters). It would take a further 22 quarters to get to zero as costs reduce with asset sell downs.

A more realistic case is the current burn rate of $15m per quarter. On that basis you'd get to Q4 2014 (19 quarters) before NAV=MCAP. Once NAV=MCAP, it's still possible to make money if there is then a recovery in rig values. Bear in mind that rig values were 30% higher at the end of 2004 and 2.6 times higher at the end of 2008 so even half the number of rigs in 2015 could be worth double today’s market cap on an eventual return to 2008 pricing. If a recovery took 2 years then they’d still have 15 rigs left and they’d only need to be worth 25% more to keep liquidation value at $32.

Similarly a drop in rig prices shortens the period of time until NAV=MCAP but bear in mind the cash flow from these old rigs is quite attractive compared to new rigs. The floor price for these rigs is scrap value. If that is all they could secure then the burn rate looks about the same as the cold storage case above. NAV = MCAP by Q4 2012.

| Case | Rig Prices | Quarters of Cash burn to NAV=MCAP* | Additional Quarters of cash burn to bankruptcy |

| Current Burn (15M per Q) | Current | 19 | 28 |

| All rigs cold stacked | Current | 11 | 22 |

| Current Burn (15M per Q) | Scrap | 11 | 22 |

* remember that if rig prices return to 2008 levels by this point in time then liquidation value will be higher than it is today even with half as many rigs!

CATALYST

The most obvious catalyst is the resolution of the Macondo blowout. Latest reports are that could be as little as a few weeks away. That is likely to initiate a gradual re-rating of GOM companies. HAWK was selling 18.80 before the blowout which is still at a substantial discount to NAV.

Aside from that a catalyst is less well defined. Over time the industry will move up from the cyclical trough. HAWK has the assets (convertible to cash) to wait.

CONCLUSION

As a going concern, or orderly liquidation, HAWK is worth around $32. From today’s price that’s over 3 times upside and management are well incented to see this happen. Even if things stay this bad for another two, or even four, years it doesn’t substantially impact the valuation as long as rig prices improve with the cyclical upturn as they always have. The stock has probably become so cheap due to liquidation of all things GOM related. While the spill has created some interesting opportunities, this one offers a robust margin of safety due to the absence of debt and the presence of substantial assets.

The price before the Macondo blowout had a 50% upside to orderly liquidation value versus 3.5 times now. At cyclical average rig rates HAWK is currently trading at .7 times EV/EBITDA and less than distressed liquidation value. New shallow water regulations have had an impact on HAWK but they have not more than halved the value of their rigs to less than the scrap value.

Valuation of Eagle Rock Energy (EROC) post transactions

Eagle rock energy has completed the transactions noted here http://longterm.blogspot.com/2009/09/natural-gas-partners-ngp-proposed.html and here http://longterm.blogspot.com/2009/10/revised-ngp-proposed-transaction-with.html .

As part of the proxy solicitation process EROC disclosed management estimates for 2010 through 2013. These were used by Madison Williams and Company to provide a fairness opinion on the transaction. We can use the data to value EROC based on management’s view of Distributable Cash flow over that period.

Management provided optimistic, pessimistic and base case estimates where the fee to NGP is paid in units, which is what occured.

| 2010 Q3 | 2010 Q4 | 2011 | 2012 | 2013 | |

| DCF Base | 20,474 | 21,820 | 105,966 | 111,516 | 116,504 |

| DCF Optimistic | 25,673 | 27,126 | 161,501 | 178,239 | 253,168 |

| DCF Pessimistic | 15,624 | 17,116 | 31,806 | 27,915 | (44,981) |

DCF – Distributable cash flow

Using that data and taking a weighted average (base*4+optimistic+pessimistic)/6 we can do a dividend discount model valuation. With an 11.8% discount rate (calculated using a fundamental beta – if anything this is a little high as average debt over the life of the cash flows will be lower than the starting debt) the weighted average value is $9.81 using the shares outstanding also provided in the disclosure documents.

The proxy also include a relative valuation of EROC based on various valuation metrics and comparable transactions. This values EROC between 7.37 and 11.06, with an average of $9.22.

This data can further be used to estimate the value of the warrants at 3.13.

A reasonable valuation for EROC is around $9 and the warrants around $3. This is higher than my earlier estimates due to a number of factors. The public equity raising has not been required. New hedges have been acquired and a lot has happened to the company and the economy

Archives

April 2003

May 2003

June 2003

July 2003

August 2003

September 2003

November 2003

January 2004

February 2004

March 2004

April 2004

May 2004

June 2004

July 2004

September 2004

October 2004

February 2005

March 2005

April 2005

May 2005

June 2005

July 2005

August 2005

September 2005

December 2005

April 2006

May 2006

June 2006

January 2007

December 2007

February 2008

April 2008

May 2008

June 2008

July 2008

August 2008

September 2008

October 2008

November 2008

December 2008

January 2009

April 2009

May 2009

July 2009

August 2009

September 2009

October 2009

January 2010

February 2010

April 2010

July 2010

August 2010

October 2010

November 2010

January 2011

February 2011

April 2011

June 2011

Disclaimer and Disclosure

Analyses are prepared from sources and data believed to be reliable, but no representation is made as to their accuracy or completeness. I am not paid by covered companies. Strategies or ideas are presented for informational purposes and should not be used as a basis for any financial decisions.

To reduce Spam click here for my email address.